- Aggressive Crypto

- Posts

- Three Dead Crypto Narratives and Their Better Replacements

Three Dead Crypto Narratives and Their Better Replacements

The 2024–2025 crypto bull market will be much different from the 2021–2022. Don't get caught up in these dead narratives. Here are better ideas.

Image made with ChatBox

When I was in high school (in the 90s), corduroy had a resurgence. It was colorful, comfortable, and diverse. Corduroy shorts, skirts, overalls, pants, and jumpsuits could be found in most US high schools and college campuses.

I liked corduroy. It was way more comfortable, expressive, looser, and lighter than jeans, and it was cool (to me) that it was ribbed in different sizes, giving each piece its unique personality.

Today, you’d be hard-pressed to find teenagers or younger people wearing corduroy. It’s time has passed. It may have a resurgence, but I wouldn’t want to bet a lot of money on that.

Like fashion, the crypto industry has certain trends and fads that were remarkably popular a few years ago but barely get discussed today. Some investors may hang onto these dated coins, waiting for them to bounce back.

Others may think these dated narratives will be vindicated once the altcoin market hits full bull. They may be right, but why take the risk? Why invest in corduroy when you can invest in today’s hottest trends?

I thought I’d put together a few narratives that captured a lot of mindshare last bull market and focus on where I’m putting my attention instead.

Narrative #1: The Metaverse

The metaverse theme was so prominent in the last bull cycle that Facebook decided to go all in and change its name to Meta. Today, we barely hear anyone talking about the Metaverse. Google trends support this assessment.

Image from Google Trends

Why the Metaverse narrative is dead this cycle:

The Metaverse platforms sucked. Decentraland, The Sandbox, the Veveverse, and Blocktopia are some of the names I remember. And it’s not like the idea of the Metaverse has completely died.

Roblox is the new term for the Metaverse and is more popular than ever. My kids are addicted to Roblox, and if I were their age, I would be too.

I’m not certain the decentralized Metaverse concept is completely dead. However, it doesn’t sound like these platforms have built much during the bear market, and their crypto prices reflect that. I’d ditch any of these dogs if I were holding them.

The theme replacing the Metaverse:

Instead of keeping my funds in dated Metaverse cryptos with other bagholders, I’d focus on this cycle's most popular theme: AI.

I don’t think decentralized AI will replace what Google, Tesla, OpenAI, or Microsoft are doing. In fact, I’ll bet that in a few years, most AI cryptos that are hot today will be just like the metaverse tokens from the last cycle.

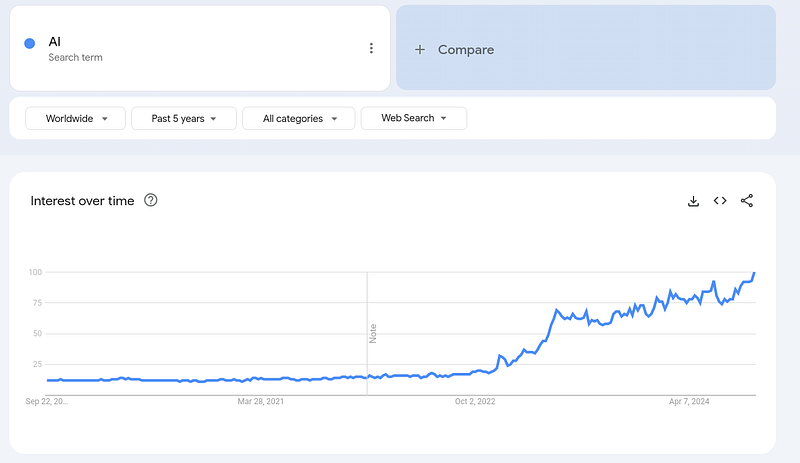

But the mindshare is in AI. Take a look at the Google Trends for AI.

Imasge from Google Trends

It’s not hard to find ideas for crypto investing in AI. I recently published an article titled "Could These 3 AI Coins Be The Next To Pop?" in which I discussed a few AI coins I’m investing in.

Narrative #2: NFTs

This narrative may be more controversial. NFTs were gigantic last cycle. Athletes and celebrities were buying Bored Apes, and they were being pitched as status symbols. I remember investing in a couple of NFTs that seemed so stupid.

I got lucky with Shadowy Super Coders, which was selling for 150+ SOL, and now they trade for 0.25 SOL. I couldn’t afford the top names on ETH, so I mostly dealt with the Solana NFTs.

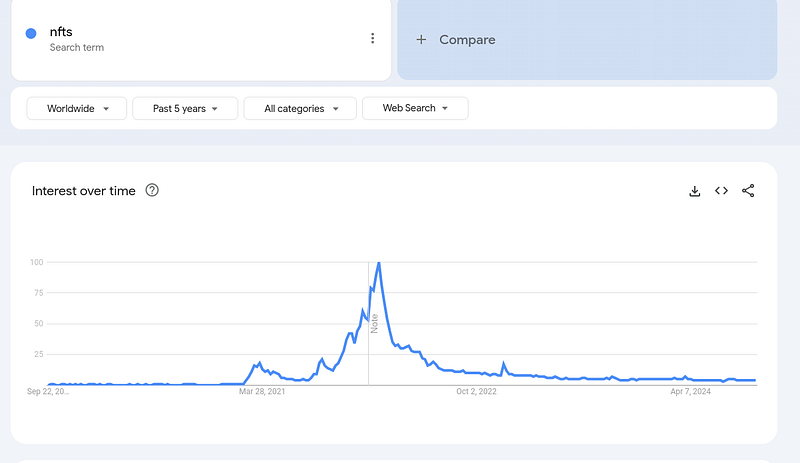

Google Trends is showing the same hopeless results with NFTs that it showed for Metaversse.

Image from Google Trends

The theme replacing NFTs:

While one could argue that blue-chip NFTs such as Bored Apes, Pudgy Penguins, or Crypto Punks could get a pump in a massive bull, memecoins have taken the NFT mindshare.

Like NFTs, memecoins enable speculators to make insane profits from a relatively stupid concept. But memecoins are more liquid, easier to understand (dogs, cats, frogs versus digital pictures), and easier to buy. For example, check out the graphs below comparing Bored Apes with today’s memecoins.

Graph for Bored Ape floor prices from CoinGecko

Graph for Pepe from CoinGecko

Bored Apes has a daily trading volume of $481K, while Pepe has nearly $2B. That is 4,158 times more trading volume! Unless you are a real collector, leave NFTs for the memory book.

The Google Trends also illustrate the growing memecoin narrative, which is the opposite of what we saw from NFTs.

Image from Google Trends

If you are still a big fan of the NFT narrative, I’d encourage you to check out Bitcoin Ordinals. These Bitcoin NFTs have fewer bagholders than Solana or Ethereum NFTs.

Narrative #3: Dated L1s that aren’t competing

In the past cycle, Cardano, Polkadot, Algorand, Zilliqa, Polygon, and Tezos, were highly regarded Layer 1s. Today, Cardano is more known for Charles Hoskinson’s opinion. Polkadot is paying massive amounts to advertise, but nobody cares. Polygon has tried a rebrand.

Unfortunately, I don’t hear any mention of Zilliqa, Algorand, and Tezos. Even worse, all of these dated Layer 1s have absolutely disgusting graphs. Instead of pasting them all here, I will chart their current price compared to their all-time highs.

Why buy or hold these when you know they are filled with bagholders ready to dump their tokens at any pump? These chains have had years to build, and (aside from Polygon) they have little to no traction.

The theme replacing dated L1s: Successful and new L1s

Solana and Ethereum have improved in the last cycle, gaining more adoption. Tron is seeing more users and total value locked on its chain. Near has the AI theme in its corner. There’s no reason to own last cycle’s plays when they haven’t innovated while these other chains have.

As far as new L1s are concerned, look for Sui, Aptos, and Sei. Fantom is rebranding to Sonic, and many influencers are pumping it up. Token unlocks are being used to create fear in these, but that’s unfounded because new tokens have always had major unlocks.

Bitcoin Layer 2s are also a narrative worth following. BOB, Bouncebit, Rootstock, Stacks, and Merlin are all building on Bitcoin. If they can create user-friendly dapps and incentives, expect DeFi users to try them out.

Key Takeaways

Holding Metaverse, NFTs, or dated L1s may have a resurgence. In a crypto bull market, anything is possible. But why fight the tide?

By investing where the mindshare is, you open yourself up to larger gains and bigger pumps. AI, memecoins, and new/successful L1s have exponentially more going for them than the other categories outlined here.

It’s easy to continue holding coins that once were up and hope they return to their glory. But would you rather invest in an aerobics studio or Ozempic? Getting rid of your dogs and replacing them with potential studs is important.

If you enjoyed this article, please clap. It helps me out. Even better, if you comment about anything other than scams, it will enhance the experience for everyone. Thank you for reading.

I own SUI, SEI, ETH, SOL, PEPE, NEAR, and APTOS. This information should not be taken as investment advice. I am no more qualified to give financial advice than to co-host Saturday Night Live with the great Steven Segal. Digital assets like crypto and NFTs involve risk, so you should always perform due diligence before investing.

Reply