- Aggressive Crypto

- Posts

- Ride the Hottest Crypto Narratives with this Strategy (my portfolio included)!

Ride the Hottest Crypto Narratives with this Strategy (my portfolio included)!

With over 10,000 tokens to invest in and everyone telling you to get into their project, here's an easy plan to capitalize on what you think will be the hottest categories.

The Cheesecake Factory has a 21-page menu with over 100 gut-busting and calorie-conscious choices. Trying to decide what to eat at the Cheesecake Factory was extremely hard for me. First, I am typically hungry when I go to restaurants, negatively impacting my decision-making ability. Second, there are so many things that look and sound so good. And finally, I want to finish my meal to get to the part I really came for…the cheesecake.

My new strategy has served me well for the past couple of years. Every time I go to the Cheesecake Factory, I order the same thing- the Thai Coconut Lime Chicken. This dish is unique to the Cheesecake Factory, has a constantly similar flavor regardless of the chef, and leaves me satisfied regardless of how hungry I am.

This strategy has dramatically improved my Cheesecake Factory experience. So, while everyone else is thumbing through the menu, I focus on my second favorite part of going to the Cheesecake Factory…the bread.

Similarly, I wanted to develop a strategy for crypto to reduce the decision-making responsibility involved with choosing, buying, and selling crypto. It can be overwhelming when every project you hear or read about sounds so compelling.

Therefore, I devised a strategy that I will share with you. This strategy is experimental and may outperform or underperform the entire crypto market. However, it is rooted in logic and has set exit points to ensure I'm not riding the winners up and back down.

Image by the author using Dall-e

Keeping it Simple

Here are the main goals of the new portfolio I wanted to build.

I'm including the three hottest narratives in crypto: Gaming, DePin (decentralized physical infrastructure networks), and AI.

I want clear exits where I can bank and keep returns.

I don't want to spend dozens of hours researching different projects.

I was able to create this portfolio in a few hours. Here are the nuts and bolts of how it works. If you want to choose different narratives, feel free to do so.

Identify the three categories (I also refer to these as narratives) you want to invest in.

Find 3 of the biggest cap projects in this category and three lower capped projects in the same category.

Invest equal amounts in all 18 cryptos (6 cryptos per category).

When the entire crypto space reaches a set market cap, sell a certain percentage of each crypto. Convert the proceeds to fiat and offboard it.

Step 1: Identifying Narratives to Invest in

Realistically,It's you don't think Gaming, DePIN, and AI are the three places you want to invest in. And that's perfectly fine. I'd encourage you to consider where capital will flow and invest accordingly.

Here's a great resource to see some of the different categories cryptos are broken into. https://www.coingecko.com/en/categories. Some cryptos will fall into multiple categories. For example, $LIDO falls into the DeFi, Liquid Staking Token, Eth 2.0 Staking, and Liquid Staking Governance categories.

Once you have identified your three categories, you can proceed to step 2- Finding three large caps and three small caps to invest in.

Image by the author using Dall-e

Step 2: Choosing the Cryptos You Want to Invest In

Now that you've identified the narratives you believe in, it's time to move to the hardest part of the strategy: the actual cryptos you want to buy.

If the category takes off, the largest cap cryptos should perform well. Since they are more established, I should expect less volatility if I invest in larger market cap projects. Picking three of the largest market-cap cryptos is easy. You use the same link as above: https://www.coingecko.com/en/categories, and then click into the category you want to invest in.

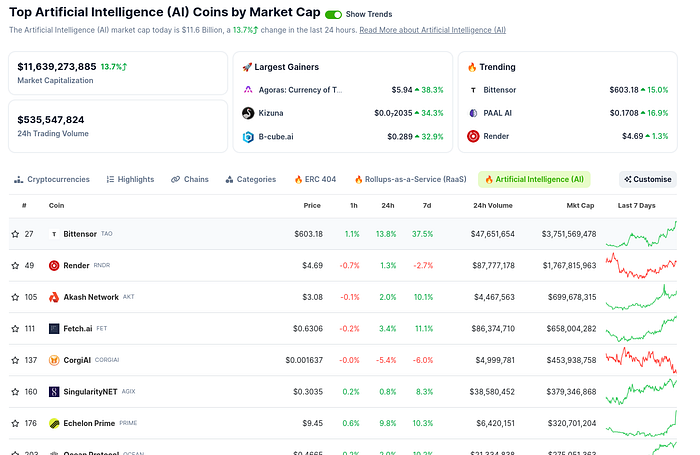

Here's an example: clicking into the 'AI' category.

https://www.coingecko.com/en/categories/artificial-intelligence

So, getting my first 3- TAO, RNDR, and AKT is pretty simple. In addition to the large caps, I want to get some explosive takeoff potential, so I will choose three smaller cap tokens in the same category.

This is the most challenging part of creating this portfolio. I had access to a friend's list to act as a starting point. At the end of this article, I will include my list to provide a starting point. Being lower-capped, these could crash and burn, or they can (hopefully) take off.

Also, being an American limited a lot of my choices. Many cryptos in these categories can only be purchased on centralized exchanges that don't operate with Americans. Eliminating these cryptos also helped shrink my pool.

Additionally, I wanted coins that I could purchase on centralized exchanges or lower-priced chains. This would reduce my buy and sell fees. Three tokens that made my final portfolio had to be purchased on Uniswap and were subject to the high Ethereum gas fees.

Image by the author using Dall-e

Step 3: Fund and Diversify the Portfolio

The next part was fun for me. I divided my total funds into 18 and began purchasing the cryptos I selected in equal dollar amounts. When I purchased one crypto, I added it to a newly created portfolio in my CoinGecko app. This way, I can closely follow how this portfolio performs.

Image by the author using Dall-E

Step 4: Keeping Profits

Different investors have different strategies for booking their gains. Many will tell you to ride the winners and cut the losers. Others will say to dollar cost average down to lower your cost basis. And some will say to rotate into something completely different.

My goal with this portfolio is not to make tough decisions. Certain cryptos will outperform other ones. Some may perform well at one point in the cycle, while others may lag or have a different time to shine. So here is my simple way of taking and keeping profits.

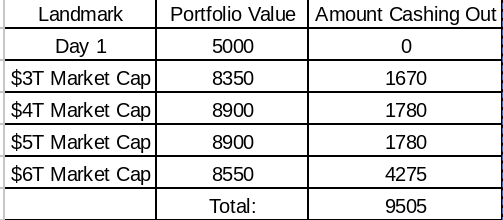

When the crypto market cap hits a $3 trillion market cap, I will sell 20% of the entire portfolio, transfer the funds to an exchange, and cash them out. Effectively, I am taking the proceeds out of the casino. Then, when the entire crypto market cap hits a $4 trillion market cap, I will sell 20% of the total portfolio and cash it out.

I will continue selling a 20% tranch at a $5 trillion market cap, and if the total market cap hits $6 trillion, I will sell 50% of the total portfolio. I am choosing $6 trillion because that's around double the peak of the last bull cycle. The prior bull cycle saw the total market cap do a 4X, going from around $800 billion to $3.2 trillion at the peak.

If the market keeps increasing, I will continue selling at trillion-dollar increments. I predict this portfolio will outperform the linear gains of the crypto market, but here's what a $5000 portfolio would look like if gains were linear with the entire crypto market.

If the total crypto market cap hits these landmarks, the portfolio value will be much higher because of the asymmetric potential for altcoins.

Image by the author using Dall-e

Flaws in the Portfolio

I've already talked about the benefits of this portfolio: 1) you have diversification. 2) you are selecting narratives you want to invest in. 3) You reduce decision-making by automatically choosing blue-chip cryptos in each category. 4) you have a clearly defined exit plan. 5) you can make insane gains if you choose the right categories.

Now, let's address some of the flaws.

The crypto market doesn't have to hit a $6 trillion or even a $3 trillion market cap. You are dealing with altcoins, and over 90% of altcoins will eventually go to zero.

You may perform better if you put your entire portfolio into one coin, and it dramatically outperforms others. Some of these tokens have already gone up a lot from their bear market bottoms, which needs to be considered.

Transaction fees may be too high when dealing with a small budget. This can be combated by finding more tokens available on centralized exchanges or low-cost networks like Solana, Binance Smart Chain, or Layer 2s.

By skimming profits early, you miss the chance for compounded gains. However, we never know when the peak will be, so your future self may be happy that you banked some gains when things were good.

Picture by author and Dall-e

Key Takeaways

This is a more passive approach to building a portfolio. It requires patience and the ability to stick to the rules. Since I set it up (around one month ago), the entire crypto market is up around 9%, and my portfolio is up 15%. This is a small sample period, but it's given me enough confidence to share it.

I'm genuinely curious what you think. Are there flaws I am overlooking? Do you think converting gains into BTC or ETH makes more sense? Is the 20% sales at each threshold too low or too high? Are my narratives misguided?

Please let me know your thoughts in the comments. I'm considering applying this same strategy to other categories as well. For example, I want to own more new layer one and two blockchains. Do you have any ideas on where this strategy can be applied? Also, if you like this article, please clap and share it with others.

Coins I have purchased for this portfolio

As stated, I have bought most of these at a slightly lower price point. Feel free to use them as a starting point for your research. I've also included their contract ID and the circulating market cap at the time of writing.

Gaming:

ICP- ryjl3-tyaaa-aaaaa-aaaba-cai- $6B

IMX- 0xf57e7e7c23978c3caec3c3548e3d615c346e79ff — $3.8B

BEAM- 0x62d0a8458ed7719fdaf978fe5929c6d342b0bfce — $1.2B

SAND- 0x3845badade8e6dff049820680d1f14bd3903a5d0 — $1B

PRIME- 0xb23d80f5fefcddaa212212f028021b41ded428cf — $320M

CROWN- GDfnEsia2WLAW5t8yx2X5j2mkfA74i5kwGdDuZHt7XmG — $67M

AI:

wTAO- 0x77e06c9eccf2e797fd462a92b6d7642ef85b0a44 — $3.6B

RNDR- 0x6de037ef9ad2725eb40118bb1702ebb27e4aeb24 — $1.75B

AKT-IBC/1480B8FD20AD5FCAE81EA87584D269547DD4D436843C1D20F15E00EB64743EF4 — $693M

FET- 0xaea46a60368a7bd060eec7df8cba43b7ef41ad85 — $656M

ARC- 0xc82e3db60a52cf7529253b4ec688f631aad9e7c2 — $46M

AGI- (Delysium) 0xaea46a60368a7bd060eec7df8cba43b7ef41ad85 — $35M

DePin:

FIL- NA — $2.7B

HNT- hntyVP6YFm1Hg25TN9WGLqM12b8TQmcknKrdu1oxWux — $1.1B

OCEAN- 0x967da4048cd07ab37855c090aaf366e4ce1b9f48 — $273M

CUDOS- 0x817bbdbc3e8a1204f3691d14bb44992841e3db35–$100M

WNT- 0x82a0e6c02b91ec9f6ff943c0a933c03dbaa19689 — $11M

BWARE- 0x013062189dc3dcc99e9cee714c513033b8d99e3c — $9M

At the time of writing, I hold all the tokens mentioned above. I have not been paid or sponsored to write this article.

This information should not be taken as investment advice. Digital assets like crypto and NFTs involve risk, so you should always perform due diligence before investing.

Follow me on Twitter.

Reply