- Aggressive Crypto

- Posts

- Did Jerome Powell Ignite The Crypto Powder Keg?

Did Jerome Powell Ignite The Crypto Powder Keg?

Image created with ChatBox

Following the crypto markets can be mind-numbing, repetitive, and depressing. As crypto traders, we want volatility and price increases. The past six months have been anything but what we enjoy about crypto investing. Influencers spit out worthless content to maintain their algorithms, analysts share ambiguous historical charts to support their opinions, and endless scams try sucking out any remaining capital they can.

But all of this may have changed yesterday. The Federal Reserve’s 50 basis point reduction in interest rates may be the momentum shift we’ve been waiting for in crypto. Momentum is the most powerful driver in the crypto market, and seeing Bitcoin’s price rise by nearly 10% within 24 hours of the Fed’s announcement could indicate that momentum is swinging back in our favor.

Why Was The Momentum So Bad

You can ask ten different people in crypto the top reason why the momentum has been so bad and get ten different answers. Some of these may include:

Monetary policy has been restrictive.

Massive German, Mount Gox, and FTX sales.

Faltering interest in the newly launched BTC and ETH ETFs.

Retail is broke and absent.

Investing dollars directed towards stocks and gold instead of crypto.

Manipulation by whales and Wall St. to stack their Bitcoin bags.

Fear of recession.

Lack of innovation, airdrops, or narratives to excite crypto traders.

Political uncertainty

Relentless SEC and governmental attacks against the industry.

The crypto market has been following historical patterns.

Why This Momentum Shift May Be The Real Thing

In reality, it was probably a combination of the above reasons that has made crypto a painful place over the past six months. Bitcoin dropped as much as 30% from its highs seen earlier in the year, and most altcoins gave back all of their gains, some even dropping below their prices from one year ago.

Crypto is prone to fakeouts, where whales and market makers manipulate the markets to liquidate over-leveraged, impatient traders. The market is so tiny that it’s probably easy for big-money investors to create a narrative, make some buys and sells, and shake out the speculators.

So, why is the interest rate drop potentially the medication for crypto’s sickness? The Fed has just signaled that the spicket for increased liquidity has been turned back on. And just like plants need sunlight to thrive, the crypto market requires more money in the system to grow meaningfully.

It’s not something to overthink. If someone who earns $500K per year visits Las Vegas, they are significantly more likely to gamble a higher amount than someone earning $30K per year. Investors just got a raise, and that can be incredibly powerful in market psychology.

Why This Could Be The Beginning

Just as I shared the different reasons that crypto has had negative momentum over the past six months, let’s examine some of the reasons the positive momentum may only be starting.

Funding rates for leverage trading in crypto are low, indicating that there isn’t too much leverage (yet) in the crypto markets.

FTX investors will be getting billions of dollars in the next quarter. Much of this could go directly into the crypto market.

Microstrategy just purchased 18,300 BTC. Historically, Microstrategy has made major purchases before a Bitcoin price increase.

Historical graphs and charts accommodate a narrative for crypto taking off.

Billions in new stablecoins have been minted and can be deployed into crypto assets.

Ordinary retail isn’t in crypto right now. If Bitcoin can exceed its all-time high, it will attract more attention from the mainstream media.

Analysts state that major institutional buyers aren’t fully positioned in the Bitcoin ETFs and that more money may be coming.

China needs to print money, and the rest of the world will relax its monetary policy in the queue of the US.

A potential Trump presidency that would ignite insane FOMO in financial markets.

Could This Be Another Headfake?

Maybe all of this is wasted writing on my part and wasted reading on your part. We may fall into recession, and any gains will turn into losses. Harris could win the presidency and give Gary Gensler even more oversight. The Bitcoin ETFs may sell off as quickly as they were bought due to portfolio rebalancing or negative quarterly performance.

While the crypto markets may have already peaked, I doubt this is the case. Here are a few reasons why I am confident this momentum shift is real.

The mainstream media constantly touts the threat of a recession. Meanwhile, we have only been in recession for one quarter since Jerome Powell became Fed Chairman. He has done a good job communicating what the Fed will do and that it is here to support its primary mandate—keeping financial markets up…I mean maintaining low inflation and high employment.

The stock and gold markets are trading at all-time highs. Meanwhile, the crypto market is 33% below its highs. Crypto is due for a positive regression, and when it goes into full bull mode, it tends to outperform other markets massively.

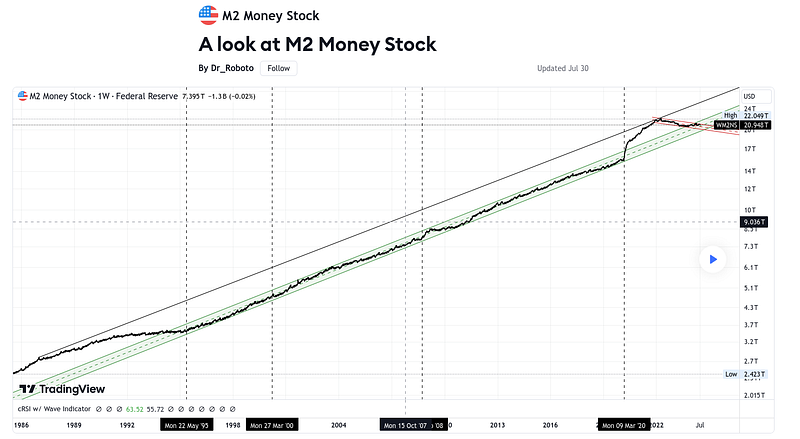

This graph by Mr_Roboto does a great job illustrating the M2 money supply in the US, which is a strong measure of liquidity. It looks like the corrective phase is over, and money printing can resume!

https://www.tradingview.com/chart/WM2NS/jQrO8pFE-A-look-at-M2-Money-Stock/

Key Takeaways

Am I telling you to go out and buy as much crypto as you can today? No…but that is exactly what I’m doing. Samson Mow has a great analogy that I will borrow when he says the crypto market is like a beach ball being pushed underwater. When the downward pressure is released, the momentum shifts quickly, and the beach ball flies out of the water.

These indicators are flashing the green light that crypto is the place to be. Of course, I am biased and could come up with a reason to be bullish on crypto anytime. That said, my conviction is sometimes higher than others; right now, it’s saying all systems go.

Clap if you agree that Jerome Powell and the Fed have released the crypto bulls. If you disagree, let me know why in the comments. And if you have anything to add, please share. I appreciate your reading.

I own Bitcoin and Bitcoin ETFs and Ethereum and Ethereum ETFs. This information should not be taken as investment advice. I am no more qualified to give financial advice than to perform hip replacement surgery on a baby hippo. Digital assets like crypto and NFTs involve risk, so you should always perform due diligence before investing.

Reply