- Aggressive Crypto

- Posts

- This DeFi Project Should Take Off After AAVE’s Rise

This DeFi Project Should Take Off After AAVE’s Rise

AAVE's token price has increased 67% in the past 60 days. Some analysts are ringing the bell about DeFi being overdue for bullish energy, and here’s a pick that may crush expectations.

Images made by ChatBox

Crypto seems like a struggling writer's room for a sitcom needing a new life. Every good television show needs new plots, conflicts, and characters each season if it wants viewers to stay tuned in. Crypto is no different. Occasionally, old narratives get twisted instead of creating brand-new storylines, making them pertinent again. This works best when you have good characters.

It sometimes seems hard to believe, but DeFi has some good platforms and applications. Unfortunately, for every good platform, there are 500 crappy ones with dishonest, incapable, or short-sighted devs. When thinking of DeFi, it’s easy to remember the OHMs that paid 27,000% APYs, the Luna UST that nearly destroyed crypto, or the Multchain exploit that lost investors millions of dollars and wreaked havoc on chains like Fantom.

Those are some examples of big names. However, I’ve speculated on multiple lesser-known platforms where my funds disappeared, sometimes in minutes- Iron Finance, Elephant’s Trunk, and Omi were poorly run ideas that cost me tens of thousands of dollars. It’s sometimes a wonder that investors are still drawn to the DeFi space with all the commotion. Unfortunately, a big part of this is due to governments not creating clear rules or regulations, making developers and entrepreneurs with moral compasses and values afraid to take career risks and join the space.

A few projects showing DeFi’s promise are Uniswap, MakerDAO, and GMX. These three projects successfully created new concepts in the decentralized finance space that have been copied and modified dozens of times. Another DeFi OG is Aave, the largest DeFi lending protocol. Recently, we’ve seen Aave’s token experience a massive 67% increase over the past 60 days. We can try to identify the reasons for this, but ultimately, more buyers have acquired Aave than sellers.

Luckily, I had a decent-sized bag from Aave. And I’m on board with creating and hoping for a DeFi narrative. If DeFi does well, I hope it does well on the back of Ethereum, which is a growing holding of mine. Since most of the money in DeFi is in Ethereum, a rising Ethereum price could easily catalyze a strong DeFi run.

I’ve taken this recent run in Aave and reallocated some of my Aave bag to another DeFi token I will discuss in this article. If I had fresh capital, I’d have kept my AAVE bag untouched and used stables, but alas, my dry powder is all but completely sitting in my cannon right now.

The project I am referring to is Lido Finance and its token, $LDO. The Lido token launched late in the last bull cycle and peaked at around $6. Today, it’s trading for $1.11, 32% below where it was one year ago and 50% down in the past 60 days. I’m using this opportunity to scoop up some more LDO and will explain why.

Lido is a liquid restaking platform, and if you aren’t familiar with how Lido Finance works, I’ll refer you to this link to learn more about it: https://members.delphidigital.io/projects/lido.

Do Fundamentals Matter in Crypto?

Strangely, crypto is one of the investment classes where fundamentals play a minor role in valuation. Sometimes, metrics are used to support narratives, but there are no earnings reports or analysts' project numbers to measure a platform’s success or lack thereof.

This is fun and nice in some ways because it lets us speculate on meme coins and airdrops and try our hands at farms or liquidity pools paying thousands of percent in APRs. On the other hand, these speculative platforms and games often pull more money out of crypto than they bring in because people get greedy, and degenerates lose all of their money.

In the meantime, fundamental platforms keep building, acquiring new users, and cementing their use cases. But they aren’t sexy, they aren’t new, and they aren’t run by hype teams trying to capture their piece of the ball of hot money.

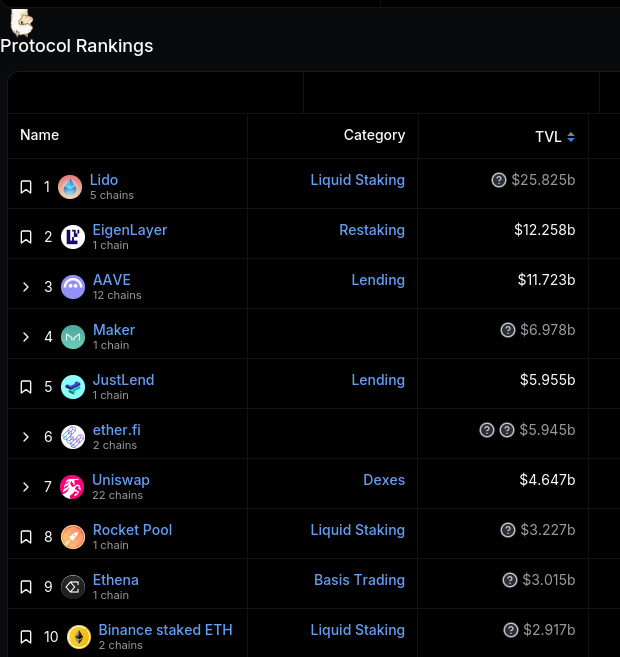

It’s ironic because the fundamentally strong platforms are the ones drawing in the most money and creating the most innovation. Still, they often aren’t priced at multiples like smart contract platforms or other categories such as memes. For example, the three largest DeFi protocols measured by total value locked (TVL) are Lido, Aave, and Maker.

The combined market cap for AAVE, LDO, and MKR tokens is less than $5 billion. Meanwhile, chains with few users such as Cardano, are valued at $13 billion, Avalanche has a $9.5 billion, top memecoins such as Dogecoin have a $15 billion market cap, and Shiba Inu has an $8 billion market cap.

Are these DeFi tokens undervalued? The market doesn’t seem to think so. But I do. Now, I will explain why Lido Finance’s fundamentals could push the LDO token higher if fundamentals are recognized.

Lido Finance has some of the strongest fundamentals in crypto

I’m not going to dive deep into the weeds here. Instead, I will share some graphs and stats to explain why LDO has a lot of upside with limited downside.

Image from https://defillama.com/

As you can see, Lido Finance has the most value locked on the chain. The $25.8B staked on Lido represents nearly 1/3 of all on-chain value. Its closest competitor, RocketPool, has nearly 90% less staked than Lido Finance. But RocketPool’s value is 25% of Lido’s. Is RocketPool overvalued, or is Lido Finance undervalued? You already know my opinion.

https://tokenterminal.com/terminal/metrics/gross-profit

Lido Finance is one of the most profitable platforms on-chain. As its TVL increases, the Lido protocol generates more fees. Ethena (which I own and am sadly down a lot in) is a VC token that isn’t getting love right now. Base only benefits COIN stockholders (which I also own). The third is LDO. Notice how big the drop is after Lido.

https://tokenterminal.com/terminal/metrics/treasury

Lido Finance has a strong treasury. More importantly, $116M of the treasury is made up mostly of majors (BTC and ETH). Compare that with Aave or Maker, which have mostly their token in their treasuries.

Catalysts that can drive the price of LDO higher

We’ve already discussed how the LDO token has experienced tremendous downward price pressure and is nearly 80% below all-time highs. We also discussed its unique value proposition, with a large moat keeping out competition and fundamentals stronger than 99.9% of crypto projects today.

Now, let’s discuss why the LDO token can take off.

We already mentioned that AAVE’s price has gone bonkers. If the DeFi narrative takes off, LDO can be a main beneficiary because every influencer knows about it and most probably owns some of it.

LDO can outperform if Ethereum outperforms. I am confident Ethereum will see brighter days this cycle. When it pumps, expect DeFi ETH plays to do well. Additionally, Lido holds ETH and BTC in its treasury, which should also increase its intrinsic value.

LDO is trading in the $1 area. This is a sweet spot for retail buyers afraid of buying more expensive tokens. Maker understands this, and they expect to do a massive token split. Even at $137, AAVE seems high-priced to retail investors who don’t understand or ignore market caps when buying more tokens.

They could tease a buyback or fee distribution. It’s ridiculous that platforms build their treasury rather than distributing their revenues or using them to buy back and burn tokens. If they make an announcement teasing such an idea, it could cause a massive green candle. They could also launch new products to their existing users or attract new users.

It’s important to recognize the risk involved in owning the LDO token. Here are the primary risks I see.

Smart contract exploit, hack, or developer rug. Unfortunately, this risk exists for all DeFi and most crypto projects. However, it’s important to recognize this so we aren’t too heavily invested in one platform/project.

Competition. If Solana or another chain manages to capture more TVL, that could impact the attractiveness of Ethereum staking and lower Lido Finance’s value proposition. Also, other liquid restaking platforms, such as RocketPool, could take market share.

DeFi continues to be undervalued and underappreciated. Perhaps, the DeFi narrative was the last bull cycle, and it doesn’t get much love this cycle, similar to what we saw with BCH, LTC, and DASH last cycle. I don’t foresee this because, unlike those obsolete tokens, DeFi platforms are being used and growing. Nonetheless, all the money could flow to VC coins or memecoins with hype budgets.

Key Takeaways

Even though Aave is used for a different purpose than Lido, I don’t think it justifies double the valuation when it earns less revenue and has lower TVL. Both are undervalued, but I think the stronger risk/return scenario is in LDO today.

Of course, crypto and logic are rarely bedfellows. If all the smart people in the world owned crypto, it would already be valued in the tens of trillions. Meanwhile, investors still own stock in companies like GM, Macy's, and plenty of small banks on the razor’s edge of insolvency.

Clap if LDO has a good chance of doing well this cycle. Clap if you own LDO or if you’ve never heard or looked at LDO before. Share your thoughts about DeFi, Aave, Lido, or any other crypto projects you are buying or owning.

I own Ethereum and Ethereum ETFs and AAVE and LDO. This information should not be taken as investment advice. I am no more qualified to give financial advice than to perform in a live stage performance of Joseph and The Amazing Technicolor Dreamcoat. Digital assets like crypto and NFTs involve risk, so you should always perform due diligence before investing.

Follow me on Twitter.

Reply