- Aggressive Crypto

- Posts

- 3 Cutting-Edge DeFi Platforms Pushing Innovation

3 Cutting-Edge DeFi Platforms Pushing Innovation

While thousands of crypto platforms exist, only some are testing and implementing new capabilities. Here are a few innovators and what they are cooking.

Image made with ChatBox

Unfortunately, the DeFi space seems to have more scammers than builders. Having fallen victim to the most recent PenPie and DeltaPrime exploits, I have even reconsidered whether it’s worth keeping my crypto in the DeFi space.

If you’ve tried out new DeFi platforms, you’ve likely fallen victim to some rug pull, exploit, hack, or “developer error.” Conversely, DeFi opens us brave users to airdrops, attractive yields, and capabilities we can’t find off-chain.

For example, try getting a loan on BTC, ETH, or SOL in the traditional market. Unless you are Michael Saylor, it’s going to be pretty hard. And finding a 10% yield on a US dollar stablecoin is pretty easy in DeFi.

While I hate losing money to rugs, hacks, exploits, and human error, I am still attracted to the space because I know it will significantly grow.

Further, I especially admire and enjoy the creativity that some teams are doing to innovate the space. While most projects copy of ‘fork’ other platforms, some development teams are looking for new use cases in DeFi.

Some notable innovators from this cycle include Parcl, which allows investors to invest in real estate markets synthetically.

Pump.fun and its forks enable anybody (including scammers, hackers, and ‘mistake-prone’ devs) to make a memecoin in seconds.

And Polymarket, where you can wager on anything from who will be the next president to what will be the highest-grossing movie in 2024.

Liquid staking is new in this cycle, and we will see whether it’s a novel way to increase liquidity or a castle made of sand.

So, instead of talking about copy-and-paste platforms, I’d like to share a few protocols that embrace creativity and are pushing innovation in the DeFi space.

Platform #1: Factor

https://app.factor.fi/

Token: Yes- $FCTR

Chain: Arbitrum

At first glance, Factor seems like a normal leveraged yield platform. Factor.fi is one of the easiest and most convenient ways to earn yield or add leverage via multiple DeFi platforms.

I’ve been using Factor for months. That said, leveraged yield aggregation isn’t unique to Factor.

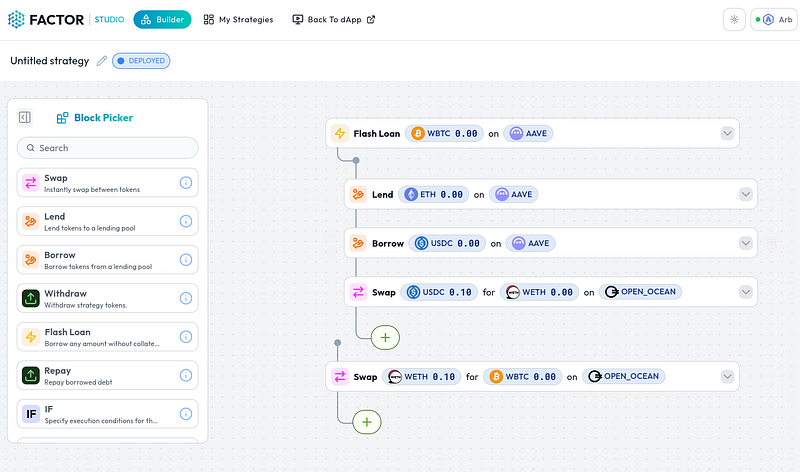

Their new Factor Studio innovation is an exciting new approach for investors to build custom DeFi strategies quickly and easily.

Currently, in beta, Factor Studio allows users to design shortcuts for making flash loans, swapping, lending, and borrowing. The user interface is extremely clean, and I can see this attracting both skilled and non-skilled investors.

Image from beta version of Factor Stuido

Instead of embracing boilerplate strategies (on yield leverage platforms) or manually doing the labor themselves, DeFi users can use Factor Studio to create shortcuts. Additionally, it opens investors up to new DeFi utilities they may not be familiar with or comfortable with.

As a satisfied Factor user, I am excited to see how Factor Studio evolves and gains adoption.

Platform #2: Ensofi

https://app.ensofi.xyz

Token: Not yet- airdrop points program in place

Chain: Currently on Solana and expanding to Sui and Movement.

Lending is one of DeFi's most attractive and biggest use cases. Aave, the largest lending platform, has over $12.5 billion in total value locked.

Lending protocols have over $33 billion in total value locked- over 1/3 of all locked crypto on-chain.

Current lending platforms rely on pools, which work well for many investors. Lenders can add to the pool, and collateralized borrowers can pull from it.

Ensofi is developing a new approach to direct peer-to-peer lending. Instead of lenders joining a pool, they directly lend to the borrower.

Like current DeFi lending protocols, the borrower must have collateral for the loan. Borrows can be liquidated if risk levels fall unsustainable, so lenders carry little risk.

At first, I wondered what the use case is for Ensofi. After reading the whitepaper, it began making more sense.

Ensofi offers fixed-rate loans for a fixed period. DeFi lending rates typically float and can be extremely volatile.

The platform fees on Ensofi are much lower than those of typical DeFi lending protocols. For example, Ensofi gets a 10% fee (5% from the lender and 5% from the borrower) on each loan. Meanwhile, Aave has a 39% spread between the lender and borrower at the time of writing.

Borrow/lending rates are 100% decided and agreed upon between the parties.

There is no risk of being unable to withdraw funds from a lending pool. Few things are worse than having your funds held because too much has been lent out.

Currently, users can borrow USDC SOL and wrapped SOL as collateral. Lenders can only lend USDC. Early adopters get points depending on loan/borrowing volume.

Platform #3: Typus Finance

https://typus.finance/yield/

Token: Not yet- airdrop points program in place

Chain: Sui

If you’ve been reading any of my recent articles, you will know that I have a raging hard-on for Sui right now.

Admittedly, I missed the Solana pump, and I think (and hope) Sui can provide real competition for Solana and Ethereum.

Before investing in Sui, I checked out its ecosystem, and one decentralized application that seemed cool was Typus Finance.

I’ve always been intrigued by options trading strategies in the stock market. However, no call or put option platforms in DeFi seem better than the derivative platforms.

Typus, on the other hand, utilizes a different options strategy: covered calls and put selling. These covered calls and put sales can last anywhere from one hour to one month on ten different assets.

I read the whitepaper and don’t completely understand how it works, but I’ve put some funds on the platform and am very happy with the returns I am getting.

Key Takeaways

Creating something new in DeFi requires skill, creativity, and guts. I applaud the teams behind these projects and hope all three platforms succeed.

Please clap for this article to increase its readership. Also, in the comments, please share other novel concepts you see in DeFi. I’d love to check out other creative and innovative ideas.

Thank you for reading.

I haven’t been paid or sponsored to write about any of these platforms.

I own FCTR and AAVE. This information should not be taken as investment advice. I am no more qualified to give financial advice than to train Uber drivers on customer service and car cleanliness. Digital assets like crypto and NFTs involve risk, so you should always perform due diligence before investing.

Reply