- Aggressive Crypto

- Posts

- 3 Altcoins You Will Regret Not Owning if a Solana ETF is Approved

3 Altcoins You Will Regret Not Owning if a Solana ETF is Approved

Solana may be next in line after the Bitcoin and Ethereum ETF approvals. Here are 3 altcoins that can outperform SOL if the approval occurs.

Image made by ChatBox

Crypto markets have been boring, like a three-hour foreign movie that keeps dragging. You finished your popcorn long ago, and now you want to see if the ending makes the investment worth it. The good news is that volatility may return sooner rather than later.

Various narratives can re-stoke the fire in the crypto market: the launch of the Ethereum ETF, the US Presidential election, the Federal Reserve lowering interest rates, and the stock markets climbing to new heights. Now, it’s become a war of attrition- can you hold during capitulation wicks, and are you bold enough to add to your positions?

I get itching to buy when I hear the clamor of $40K Bitcoin and a potential end of the bull market. Fear in the crypto markets has increased, and influencers are running out of things to discuss. Times like these are when I like to strategize and implement new investments.

I make these investments knowing they could and probably will dip in value. But I’ve never been good at catching the bottom, and I am confident these altcoins can provide tremendous returns when the market regains popularity.

Image made by ChatBox

The Thesis

A Solana ETF doesn’t need approval for another Solana season to occur. Merely talking about a potential ETF and building the storyline is enough to make investors chase the trade. The last Solana season peaked in March, from around $20 in October 2023 to $200 in March 2024. Since March, SOL has retraced to $142, about 30% lower than recent highs.

When the next Solana run occurs, I want to position myself to outperform the market and capitalize on large gains. As mentioned in previous articles, I own a decent-sized position in WIF, which is my primary exposure to the Solana memecoin market. There are too many memecoin choices for me on Solana and rugpulls to try and chase low caps in a rough market.

So, if I’m not looking for memecoins, I will have to go back to using logic to invest wisely. I will explain the three altcoins in the Solana ecosystem I have purchased and why I believe they can outperform in the next Solana pump.

Image made by ChatBox

Coin #1: An Obvious Pick

Jupiter is the cornerstone of the Solana on-chain ecosystem. The main DEX on Solana is Raydium, which has one of the worst UI experiences in crypto. Therefore, most users will trade on Jupiter, an alternative to Raydium or any other Solana dexes.

Jupiter is more than an aggregator allowing traders to swap crypto quickly and efficiently. There is a perps platform where speculators can trade with leverage, and it has features such as a DCA option and a brand-new interface called Ape.jup.ag. Ape.jup.ag is a platform to make memecoin and shitcoin trading (the bread and butter of Solana) easy and as user-friendly as possible.

If Solana takes off, it will increase Jupiter's metrics and make the $JUP token more attractive. There aren’t too many DEX tokens on Solana, and the only one that makes any sense in owning (to me) is $JUP.

Today, Jupiter has a $1.05B circulating market cap and nearly an $8B fully diluted value. The low float and high FDV may scare astute investors off because it means dilution will be coming. However, Jupiter has unique tokenomics where 50% goes to the team and 50% gets distributed to the community.

Holders who stake their $JUP and vote get staking rewards for the activity. Additionally, platform users are supposed to receive an airdrop every January. The $JUP token has no whitepaper, and the team wants true community governance. Here are a few more bullet points on why I’m investing in $JUP.

The team and investors' goals are aligned. If the team succeeds, investors will succeed.

During the last Solana season, $JUP hit $1.75. It has retraced 60% from the peak, and it’s trading close to its launch price.

The team is continually building and delivering.

Image made using ChatBox

Coin #2: Catching a Falling Knife

Typically, it’s a bad idea to try to catch a falling knife when investing. Sometimes, it can be a great play if you get lucky and buy close to the bottom. Other times, you get destroyed and feel stupid for thinking you are smarter than the market.

I recently purchased a falling knife candidate, $ZEUS. In two days, I’m already down 10%. But, as stated earlier, I’m okay with staring at losses while my strategy plays out.

Zeus Network is a layer 2 built on Solana that will bring Bitcoin to the Solana ecosystem. Still in its testnet, I understand that Zeus Network will function similarly to Merlin, BounceBit, and Build on Bitcoin on Ethereum. Interacting with Solana can add tremendous value to Bitcoin holders by letting them unlock liquidity and earn yield in the Solana ecosystem.

The $ZEUS token has been a nightmare since its launch, down 82% from its peak three months ago in April. Like many new launches, it had a low initial float and a fully diluted valuation that didn’t impress the market.

Image from CoinGecko

However, even though it’s still in testnet and $ZEUS has been a garbage investment, I have a few reasons to be optimistic, especially when Solana season comes again.

The $ZEUS circulating market cap is $32M, and the fully diluted valuation (FDV)is $191M. Meanwhile, Merlin Chain’s $MERL has a $97M circulating market cap and $577M FDV. BounceBit has a $166M circulating market cap and $853M FDV. As far as I know, the Zeus network has no competitors on Solana and seems like a good value.

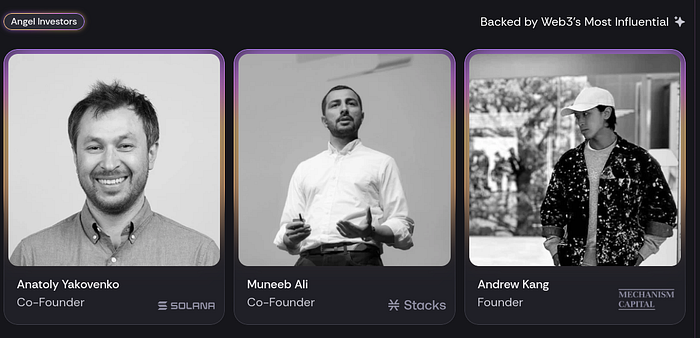

Look at the Angel Investors. I’m pretty sure the Solana co-founder wants the Zeus network to be successful, and it’s a team I want to invest with.

Image from Zeusnetwork.xyz

The Zeus network will deploy 40% of its supply to the ecosystem. I’m hopeful some of these $ZEUS tokens go to current holders via staking. Regardless, having a large supply dedicated to the ecosystem will draw more eyes to the project.

Image made using ChatBox

Coin #3: The Gutshot

In poker, there’s a term for a challenging straight draw called a “gutshot.” Unlike an open-ended straight, where the player can get the straight from two cards, a gutshot straight requires only one card. My third pick is a gutshot, but I believe it has tremendous odds that can favor us.

$LIKE is the token for Only1 app, a decentralized version of OnlyFans. The $LIKE token has traded since 2021, so it saw success in the last bull run. Only1 is a functioning platform and real users. While it has flaws in its monetization schedule (charging the same amount to creators as OnlyFans), I can see the easy-to-understand narrative taking off in another Solana season.

Today, $LIKE is trading for $0.044, a far cry from its $1.00 2021 peak. However, in April it traded for as high as $0.26, meaning it’s down 81% in the past few months. Further, it has a nearly $15M circulating valuation and only a $22M FDV.

Here are a few more reasons why I am investing in the $LIKE token:

There are few, if any, competitors in this space. Sex is among the most effective ways to get new users to a technology. Like they say, “sex sells.”

Venture funding was for $0.032. The funding was before the platform launched had users, and was more of a concept. Today, we can get in at similar pricing-with an actual platform.

Recently, Only1 teamed up with crypto influencer Ansem and launched a new page called “Ansem’s Angels.” Last month, one Solana user spent $36K worth of Solana on Only1 for a date with one of Ansem’s Angels and Playboy model Jaylene Cook. It could be tremendously valuable if Only1 becomes a decentralized matchmaking service. Regardless, this brought positive attention to the platform.

Key Takeaways

Buying altcoins that have dropped 60–80% in the past few months takes some serious stones. As mentioned, I'm down on all these investments in the past couple of days. Obviously, that is not too fun. At the same time, I am making these investments in anticipation of another Solana season, and I don’t know when to expect it.

Watch 10 videos, look at 10 Tweets, or read 10 articles and you will get different opinions. I’m not trying to predict what will happen this week or in July. I am more interested in positioning myself in opportunities with high upside and a logical narrative.

When Solana gets its next burst, I anticipate (and hope) these altcoins outperform SOL. At the same time, with increased upside, there is always increased risk.

Let me know what you think of these altcoin picks. Am I entering the market too early for altcoins? Do you think it’s wiser to just position yourself in SOL and get exposure to Solana that way? Do you think speculating on $WIF or $BONK are smarter and more left curve plays? Share your thoughts in the comments.

I own a position in all of the coins mentioned here. This information should not be taken as investment advice. I am no more qualified to give financial advice than to dance like a ballerina. Digital assets like crypto and NFTs involve risk, so you should always perform due diligence before investing.

Follow me on Twitter.

Reply