- Aggressive Crypto

- Posts

- $2.5M Arbitrum Incentive Boosts Protocol You Probably Haven’t Heard Of

$2.5M Arbitrum Incentive Boosts Protocol You Probably Haven’t Heard Of

While everyone is fishing for airdrops, why not look at a low-cap project that just received a $2.5 million short-term incentive program grant from the Arbitrum DAO?

Image by Dall-E

Did you miss the JITO airdrop? Are you kicking yourself for not buying BONK or Solana? Are you spending countless hours doing transactions on copycat dexes and lending protocols, hoping to get some shavings of a potential airdrop?

If you check any of these boxes, you aren’t alone. But I have some good news for you. And I don’t think the secret is completely out yet. It’s an update on a project I wrote extensively about earlier in the year. And it’s sitting on a $2.5 million powder keg looking to explode.

We will witness what happens when you distribute $2.5 million in rewards to a protocol with a $3.5 million market cap. 100% of the funds will be distributed over the next 11 weeks (week 1 ends today), and the token has only doubled in value. It can go much higher.

I know you haven’t guessed the platform yet, and I’ll save you the time of looking it up. It’s called Ramses Exchange, a Solidly fork running on Arbitrum. If you aren’t familiar with how Solidly works, I wrote a series of articles explaining it earlier in the year when the Ramses exchange was launched. You can check them out here: http://www.aggressivecrypto.com. Some of the info is outdated as the platform has transitioned to concentrated liquidity, but you can learn the basic framework there.

Why Ramses Run May Just Be Starting

Image from https://arbitrum.foundation/grants

The people behind Arbitrum are smart. They’ve quickly become the top L2 on Ethereum and have amassed over 154,000 monthly users (more than Optimism and Avalanche combined). And the ARB token is on a tear. Last month, they distributed 50 million ARB tokens from the DAO to projects, and here are the goals of the short-term incentive program (STIP):

This proposal represents a critical opportunity for our community to:

* Support diverse, emerging builders and make Arbitrum a welcoming environment for new projects

* Double the sample size and diversity of stages and categories in the STIP data set

* Uphold constitutional values of Inclusion vs Exclusion

* Avoid potentially irreversible harm of crushing small, high potential builders

Fortunately, Ramses Exchange secured one of the largest allotments of 1.248 million ARB tokens.

Image from https://forum.arbitrum.foundation/t/proposal-to-backfund-successful-stip-proposals-savvy-dao-final/19046

At the time of writing, the street value of this ARB is $2.45 million. Ramses will distribute 100% of this ARB to liquidity providers over three months. The first week’s results are promising. Ramses has generated nearly $300K in revenue. That $300K is being distributed to Ramses stakers.

Ramses has a circulating market cap of $3.7M as I am writing this. Revenue will increase as more liquidity is drawn to the platform and bribes increase. However, even if it stays equal for all 12 weeks, Ramses would still distribute $3.6 million in revenues.

How I’m Getting Paid to Do Nothing

Image by Dall-E

I’m not smart enough or willing to take the time to manage concentrated liquidity. I will leave that to the pros. However, I want some of this massive revenue Ramses Exchange is earning.

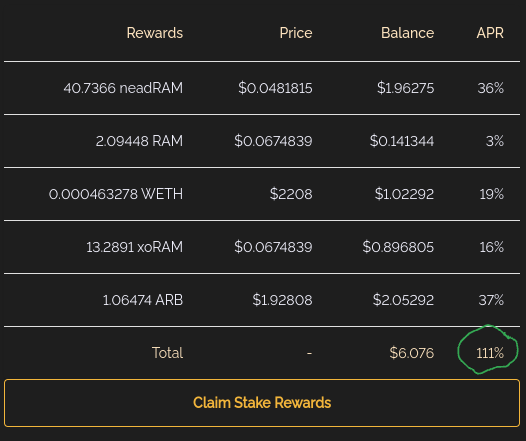

So, I take advantage of the second layer built on Ramses, The Ennead. The Ennead offers a wrapped token called neadRAM-Token Address: 0x40301951af3f80b8c1744ca77e55111dd3c1dba1. I buy my neadRAM on Firebird Finance. It trades at a slight discount to the Ramses token but is liquid. Then, I stake my neadRAM on the Ennead and earn insane rewards constantly. Here’s a screenshot of the rewards as I am writing this.

I love that these rewards come in ETH, ARB, and neadRAM. I re-stake my neadRAM and hold my ETH and ARB, which I hope to appreciate in 2024. I have been earning steady rewards for the past eight months. Now, I expect the rewards and the neadRAM token to increase in value.

I don’t need to vote, add liquidity, or research bribes. I go onto the Ennead daily, collect my rewards, and re-stake my neadRAM when I feel like it.

Key Takeaways

Most DeFi projects are garbage created by greedy garbage developers. Top-notch teams manage Ramses and the Ennead (they are separate but work together). The team’s integrity is why I believe they successfully secured such a massive STIP.

My neadRAM purchase and staking is one of the best risk/reward scenarios going into 2024. Please check out the opportunity and get your piece of the $2.5 million the Arbitrum DAO has granted Ramses.

If you are confused or need help, the Ramses and Ennead Discords are extremely responsive and helpful. Here are links to their respective Discords below.

Ramses Discord: https://discord.com/invite/ramses

The Ennead Discord: https://discord.com/invite/tFHQBXk2X7

At the time of writing, I do hold and take $neadRAM tokens. I have not been paid or sponsored to write this article.

This information should not be taken as investment advice. Digital assets like crypto and NFTs involve risk, so you should always perform due diligence before investing.

Reply